We asked ourselves, “How much money did we want and need for our future?” When we set up our budget it was the perfect time to talk about our long-term financial goals.

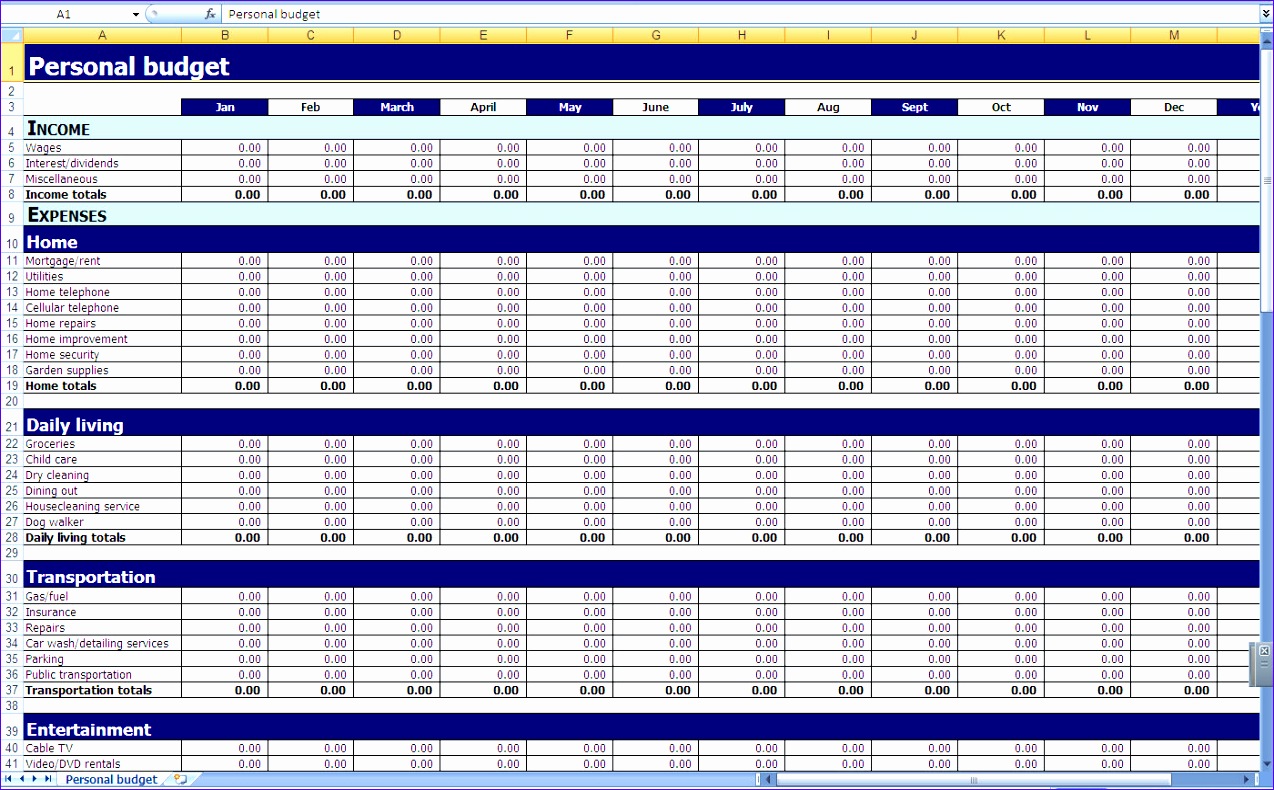

We attempted to choose realistic and reasonable amounts for each category. Then we broke each major category into subcategories:

Excel monthly expenses how to#

How to create a monthly budgetīasically, we looked at our monthly income and broke it down into 3 major categories: Think of it this way: a few jabs or punches month by month is far better than the inevitable financial knock-out after months of neglect. Third, we also maintain transparency through weekly or monthly financial meetings where we discuss exactly where all the money went.įacing your finances is incredibly brave, and it is not always easy. Debt, bills, savings-all of this was covered in detail with complete honesty.

Excel monthly expenses full#

Second, we gave full disclosure of our current financial situation. Since both of us regularly access our financial accounts, we are less likely to deviate from the monthly budget or fall into the treacherous troubled waters of financial infidelity (i.e. With the added dimension of accountability, we both have the ability to check bank accounts and credit card balances at any given time. It’s free and simple to use.įor us, sharing our passwords creates a sense of accountability. In order to create transparency, we first shared all of our usernames and passwords and stored them securely using a program called Last Pass.

If you need help knowing how to create a monthly budget, my friend Lauren is guest posting today about her successful monthly budget, how she created it, and even included a free excel monthly budget template for an entire year.

0 kommentar(er)

0 kommentar(er)